Every person paid to do a job receives a salary payslip from their employer, but few people realize how important it is to look it over. Are you frequently perplexed by phrases like gross salary, tax deductions, and reimbursements? Worry not! Here, we will go through the most important parts of your payslip.

What is a Payslip?

A payslip is an official document that shows an employee’s monthly salary as well as various deductions. An employee payslip, which is usually issued once or twice a month, contains information on one’s employment status and compensation components.

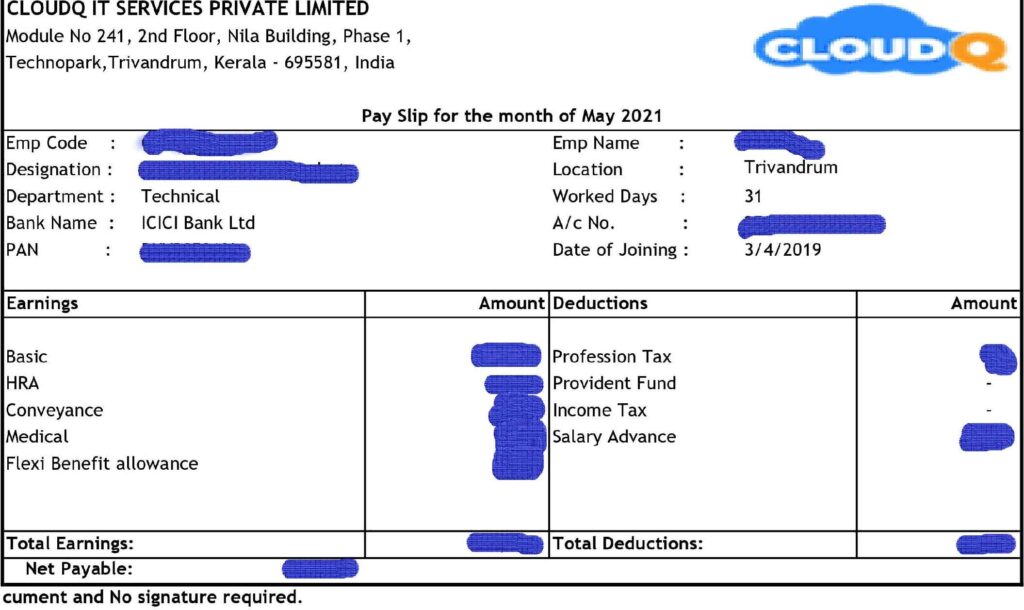

Components of a Payslip

A salary slip is a document that breaks down your pay into its many components. These components are divided into two categories: income and deductions.

Income

The following income components are included in most Indian companies’ payslips:

- Basic Salary: It is the most important component of remuneration, accounting for around 35% to 40% of total pay. It forms the basis for determining the many other components of the payslip.

- Dearness Allowance: It is a payment made to employees to help them in dealing with the effects of inflation.

- House Rent Allowance (HRA): HRA is calculated depending on the location of a worker’s rental residence and is generally between 40% and 50% of their basic pay.

- Conveyance Allowance: It is an allowance that is used to pay the cost of transportation from home to work and back again.

- Medical Allowance: It is an allowance to cover the employee’s medical expenditures while on the job.

- Flexi Benefit Allowance: Employees are given a specific amount of money to spend on employee benefits of their choosing.

- Performance and Special Allowance: It is frequently given as a kind of motivation to employees.

Deductions

Under the deductions section of the payslip, you’ll see the following items:

- Provident Fund: This is the mandatory contribution that businesses deduct from your salary and deposit in your provident fund account, in addition to the employer’s contribution.

- Professional Tax: It is a tax levied based on the employee’s tax slab that is only applicable in a few Indian states.

- Income Tax: It is deducted from the employee’s wage by the employer on behalf of the income tax department, based on the employee’s tax slab and other variables.

- Employees’ State Insurance (ESI): ESI is a contributory fund that allows Indian employees to contribute to a self-funded healthcare insurance fund, which is funded by both the employee and the company.

Salary Slip Format

Importance of a Payslip

Payslips are required for a variety of reasons. The following are some of the primary benefits you will obtain from them:

- Income Tax Payment: It determines the amount of tax to be paid, or refund to be claimed, by the employee for the year.

- Helps with Borrowing: Salary slips provide lenders confidence that their loans will be repaid. It is a necessary document for obtaining loans, credit, mortgages, and other types of borrowings.

- Assist with Offer Evaluation: Employees might use their prior payslips to compare new job offers. It can also help in salary negotiations with new employers or for new roles.

- Legal Authorization of Employment: Salary slips are essential evidence of employment. When applying for travel permits or admittance to institutions, applicants are usually requested to present a copy of their payslips as evidence of work and designation.

Hopefully, this provided some clarity about the importance of payslips. If your company does not provide salary slips and you need one, you might be able to request one from them.

Linkedin

Linkedin